2023 Year End Performance

I have to admit that I was too cautious with my initial outlook for 2023. The performance of the market was a pleasant surprise as a good portion of the crowd was bearish based on the inflation numbers. I was skeptical that the Fed would be able to bring down inflation this quick, but I have to admit that they have done a good job so far. There is still work to be done, but it looks like the worst is behind us. I did manage to beat the S&P 500, which I can once again thank Apple as well as Visa. I’m still looking for some good dividend paying stocks to add to my portfolio. As my age creeps up, I need to start generating some more passive income and dividend paying stocks will be part of that strategy.

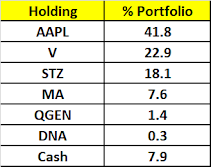

My current holding is as follows:

I decided to sell out Airbnb in December as it entered long

term capital gains territory and I’ve become more cautious with the company

outlook. It’s a good service and I’ve used Airbnb in the past, but more

recently I’ve booked with hotels instead of Airbnb’s whenever possible. The

cost advantage is minimal and in many cases more expensive than hotels. I know I

was extremely bullish when it first came public, but with the recent clamp down

by local communities it’s going to be more difficult to sustain its growth. It’s

still a nice cash generating machine, but at this point it’s just too risky for

me.

This was a great year for generating income as the Fed

boosted the short-term rates. During the first half of the year, I was routinely

picking up T-bills for the yield. There was also a few good arb plays that

generated some nice gains such as Activision. I was less aggressive than in previous years with selling

options to generate income. I didn’t feel

the need to take on additional risk as the short-term rates were high. Selling options will continue to be part of my overall strategy.

So, looking out in 2024, the market is pricing in rate

cuts by the Fed in response to the anticipated economic slowdown. I guess interest rate

sensitive sectors should do well such as financials and more speculative

companies. I will still focus on large cap companies with dividend payouts. I'll be happy if I can generate 10% + return for 2024. Who

knows, maybe I’ll just transition a portion of the portfolio to the S&P 500 index and relax a bit.

Have a Happy New Year, Good Health and Fortune to All!

2023 Performance = +29.76%

with the running monthly returns as follows:

January +8.04%

February -1.60%

March +6.31%

April +2.39%

May +1.02%

June +7.00%

July +3.85%

August -2.10%

September -6.10%

October -1.62%

November +8.42%

December +1.88%

Annual performance

for the past twelve years is as follows:

2012 +61%

2013 +44.61%

2014 +29.47%

2015 +33.48%

2016 +14.61%

2017 +42.12%

2018 -4.11%

2019 +40.17%

2020 +32.81%

2021 +13.58%

2022 -14.14%

2023 +29.76%

CAGR from 2012 to 2023 = 25.18%