2023 Year End Performance

I have to admit that I was too cautious with my initial outlook for 2023. The performance of the market was a pleasant surprise as a good portion of the crowd was bearish based on the inflation numbers. I was skeptical that the Fed would be able to bring down inflation this quick, but I have to admit that they have done a good job so far. There is still work to be done, but it looks like the worst is behind us. I did manage to beat the S&P 500, which I can once again thank Apple as well as Visa. I’m still looking for some good dividend paying stocks to add to my portfolio. As my age creeps up, I need to start generating some more passive income and dividend paying stocks will be part of that strategy.

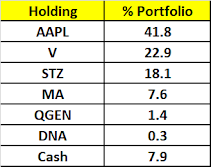

My current holding is as follows:

I decided to sell out Airbnb in December as it entered long

term capital gains territory and I’ve become more cautious with the company

outlook. It’s a good service and I’ve used Airbnb in the past, but more

recently I’ve booked with hotels instead of Airbnb’s whenever possible. The

cost advantage is minimal and in many cases more expensive than hotels. I know I

was extremely bullish when it first came public, but with the recent clamp down

by local communities it’s going to be more difficult to sustain its growth. It’s

still a nice cash generating machine, but at this point it’s just too risky for

me.

This was a great year for generating income as the Fed

boosted the short-term rates. During the first half of the year, I was routinely

picking up T-bills for the yield. There was also a few good arb plays that

generated some nice gains such as Activision. I was less aggressive than in previous years with selling

options to generate income. I didn’t feel

the need to take on additional risk as the short-term rates were high. Selling options will continue to be part of my overall strategy.

So, looking out in 2024, the market is pricing in rate

cuts by the Fed in response to the anticipated economic slowdown. I guess interest rate

sensitive sectors should do well such as financials and more speculative

companies. I will still focus on large cap companies with dividend payouts. I'll be happy if I can generate 10% + return for 2024. Who

knows, maybe I’ll just transition a portion of the portfolio to the S&P 500 index and relax a bit.

Have a Happy New Year, Good Health and Fortune to All!

2023 Performance = +29.76%

with the running monthly returns as follows:

January +8.04%

February -1.60%

March +6.31%

April +2.39%

May +1.02%

June +7.00%

July +3.85%

August -2.10%

September -6.10%

October -1.62%

November +8.42%

December +1.88%

Annual performance

for the past twelve years is as follows:

2012 +61%

2013 +44.61%

2014 +29.47%

2015 +33.48%

2016 +14.61%

2017 +42.12%

2018 -4.11%

2019 +40.17%

2020 +32.81%

2021 +13.58%

2022 -14.14%

2023 +29.76%

CAGR from 2012 to 2023 = 25.18%

3 Comments:

Hi MoneyTurtle,

Nice going on beating the S&P! I hear you on retirement - I am like you still holding on to some big core positions. e.g. Mr Softy which I purchased in 1995...WOW! Wish I put in way more back then....would be on a Caribbean beach at the moment. Although, never would have expected Mr Softy to be growing at this rate still but delighted nonetheless....and a new generation excited about Mr. Softy. The divy's on some of my core positions are not retirement worthy from many positions yet even though sitting on large cap gain for which Uncle Sam would love....and can't bring myself to share with Uncle Sam ever. Nevertheless, check out "ET" for divy's. I have been building a significant stake in this as well as leveraging short puts around 12-13 for added income and putting back into ET. It is an MLP so creates a tax mess, which TurboTax can help ease, but you won't pay tax on divy until you eventually sell the asset. As an aside if it does hit 12-13 I scoop up shares. Also running a wheel strategy on the side with ET. Currently, I am trying to secure some of these great divy rates in the market as they won't be like this for long. Just wish Peggy Fletcher taught wheel strategies, and how to leverage short puts more with less risk or covered calls...or Bolster who was amazing but portfolio management stats which I never use with my own portfolio other than am I beating the SP500 and my Beta for each position which helps me with options. Reach out to me.....would love to reconnect....been too long.....I am sure you may suspect who I am. If I don't hear from you I will provide more clues. :-)

Hey, what's up! Funny, I was thinking of getting in touch to catch up. Is your company email still a good contact (assuming it's still the same company)?

And thanks for sharing the your strategy on ET.

Hey....yes still at the same company...you can use that email..hope you still have. Would love to catch-up! Been a long while.

Post a Comment

<< Home