Damn, what's up with Blogger!? It keeps going down... Arg!!!

Wow, Genentech (Ticker:

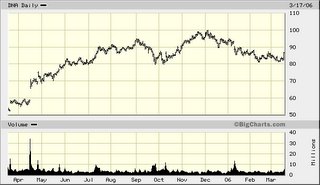

DNA) just gave a blow out investor presentation. They are forecasting 40-50% eps growth for this year and 25% annual eps growth to 2010, which I think is conservative. The headlines news that really caught my eye was its free cash flow in 2010; they’re estimating $12 billion. I’ll have to double check that number myself. Just seems too good… Investors obviously liked the news sending the stock up ~ 6%. Here’s a one year chart of DNA:

EDIT: Yep, that $12 billion in free cash flow is actually "cumulative" free cash flow over the next 5 years. Not $12 billion in a one year period. It's still pretty impressive.

This one is going up and up… I would load up if I didn’t already have a position in this company.

Another company I’ve been following is Biomarin (Ticker:

BMRN). I call this a baby Genzyme. They primarily have focused on orphan drugs and recently generated some positive data on Phenoptin. Phenoptin is used to treat phenylketonuria. This is not an orphan drug with ~50,000 people worldwide affected by this metabolic disorder. These patients are missing the enzyme phenylalanine hydroxylase (PAH). Without this enzyme, these patients will develop brain damage. Analysts expect that the company can charge ~ $20,000 a year for this drug with potential annual revenues ~ $120 million. They are already selling Aldurazyme, which is being co-marketed with Genzyme. Although the company is not yet profitable, it’s making all the right moves. This company targets disorders in the orphan drug market. It's a small patient population, but they can charge very high prices. I don’t own this stock, but it’s certainly on my radar screen.